SYSTEMS OVER FEELINGS. DATA OVER DRAMA.

Stop trying to fix your finances with "Motivation."

You need a Protocol.

Information is free. AI can give you the math. But it cannot fix the hidden behaviors that keep sabotaging your bank account.

Why are you still stressed about money?

Your Instinct: "I just need to make more money. If I had a higher income, I would be safe."

The Reality: You have likely made "more money" before, and it disappeared.

This is called The Drift. If you pour water into a bucket with holes, more water does not fix the problem. It just creates wet feet. Your financial anxiety isn't a math problem. It is a behavior problem.

The Solution: You don't need a budget app that shames you. You need a Financial Architecture that works with your psychology, not against it.

I'm not a "Money Coach." I'm a Survivor.

My name is Sofia Roper. Today, I help women build Second Acts. But I didn't learn this in a textbook.

At age 29, I lost my jewelry business in a divorce and had to rebuild from debt.

At age 60, I lost everything again. I had maxed-out credit cards, zero savings, and I had to drive for Uber just to survive.

I know the shame of being "smart but broke." I know the fear of the mailbox.

But I also know how to fix it. I used my background as a Financial Advisor to build a system that ignores the fluff and focuses on the Safety Architecture.

I didn't rebuild my life by "manifesting." I rebuilt it with a Protocol. And that is exactly what I am handing you today.

"Can't I just ask AI how to get out of debt?"

Yes. You can. AI will give you the math. It will tell you the "Snowball Method."

But AI doesn't know your history.

‣ It doesn't know you spend when you are lonely.

‣ It doesn't know you avoid your bank account because your father told you money was evil.

‣ It doesn't know that "strict budgets" trigger your rebellion.

AI gives you Data. I give you Behavioral Correction.

WHAT YOU WILL LEARN

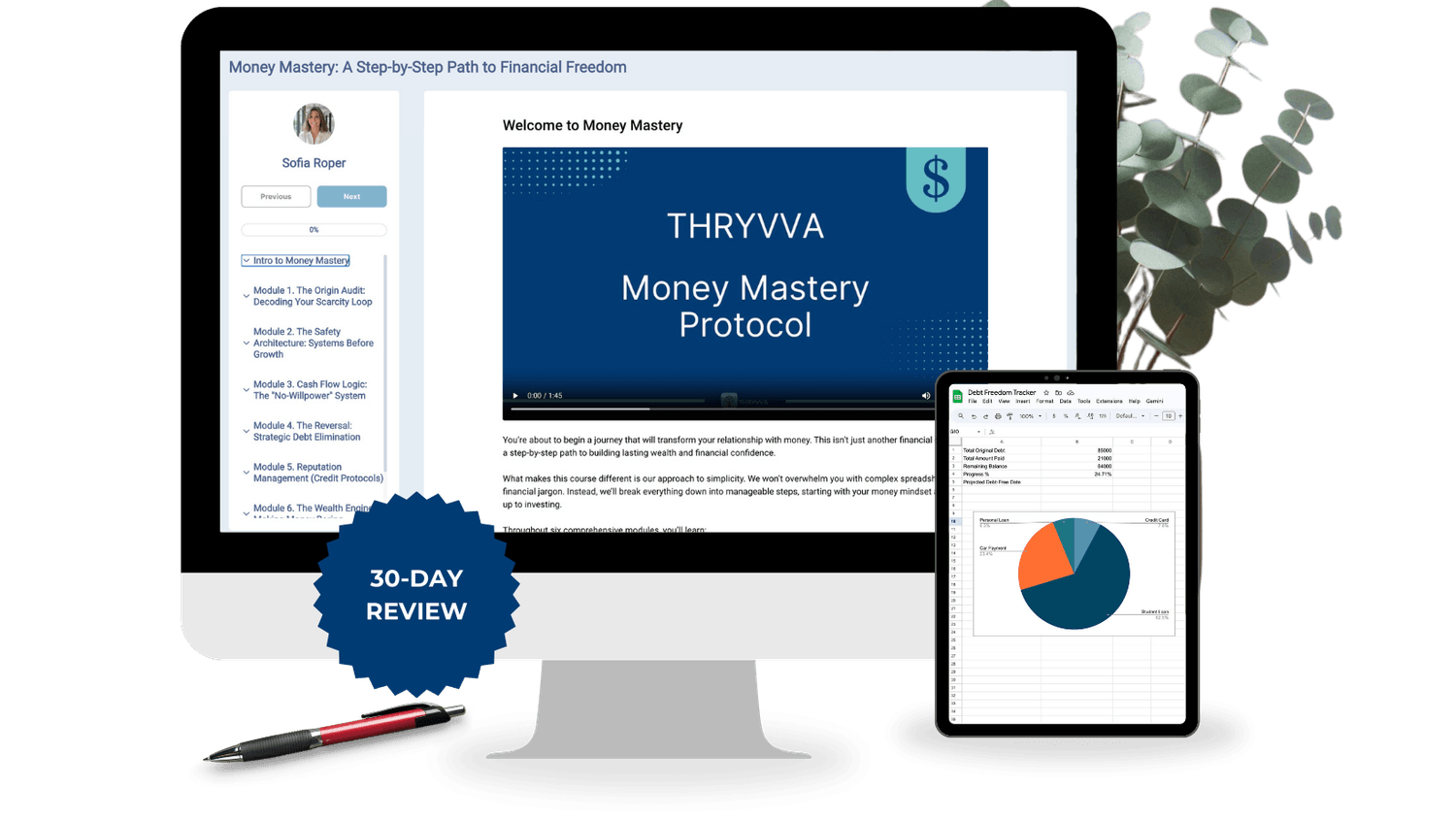

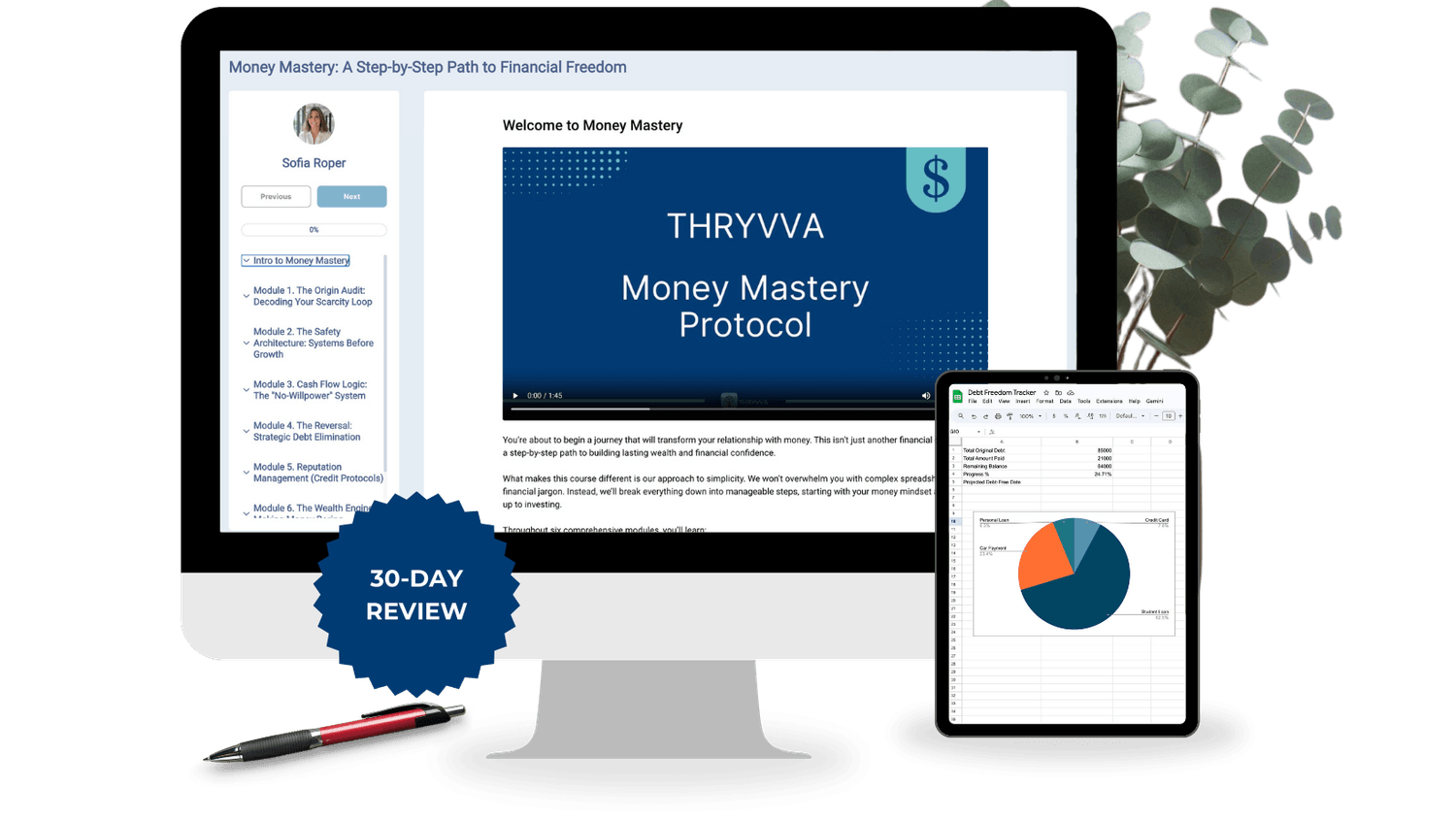

Inside The Money Mastery Protocol

We don't start with spreadsheets. We start with the "Money Story" that is running in your subconscious. We find the leak before we plug it.

Stop trying to "grow" before you are safe. We build the foundation that lets your nervous system finally relax.

The "No-Willpower" Budgeting System. How to manage money without feeling like you are on a diet.

Strategic Debt Elimination. We choose the mathematical path that clears your name the fastest.

Your credit score is your reputation. We fix it so you can leverage it.

Investing simply. We make money boring so you can go live your life.

Choose Your Level of Execution

THE ASSET PROTOCOL (DIY)

Select The Asset Protocol if you are self-disciplined, good with instructions, and just need the right system to follow.

For the self-starter who just needs the map.

Full Access to All 6 Modules.

All Workbooks & Spreadsheets.

Lifetime Access to updates.

No personal review.

THE ARCHITECT’S AUDIT

Select The Architect's Audit if you know you have "behavioral leaks" and need a professional to catch mistakes before they cost you money.

Everything in DIY PLUS 30 Days of Strategic Review

For the woman who wants insurance against mistakes.

I audit your homework: Submit your debt sheet; I redline it.

Feedback: If you're stuck, I record a video showing you the fix.

The "Eye on Your Numbers" Guarantee: I won't let you drift.

FAQ

Good. You don't need to be. I am the "Digital Translator." The spreadsheets are pre-built. You just type in the box. If you can type, you can do this.

I started over at 60 with negative net worth. You are never too far behind to build a Safety Architecture.

Because mistakes are expensive. The $297 fee is the cost of having a former Financial Advisor & personal finance coach verify your plan. It is insurance against a bad strategy.

Your instinct says to wait until you "feel ready." But feelings are what got you into this drift. Therefore, you must choose a System.

The doors are open. Pick your path.